Home » USA Brokerage Accounts

United States

Popular Online Brokerage Accounts

Choosing the right brokerage account is a key step in managing your investments. This page highlights important features, fees, and options to help you make informed comparisons and find the account that suits your needs.

Understanding Brokerage Accounts in the U.S.

A brokerage account is a financial tool that allows individuals to buy, sell, and hold investments such as stocks, bonds, mutual funds, and ETFs. These accounts are offered by brokerage firms, which act as intermediaries between you and the financial markets. Whether you’re saving for retirement, building wealth, or exploring short-term trading opportunities, a brokerage account is a flexible way to manage your investments.

How Brokerage Accounts Work

When you open a brokerage account, you deposit funds that can be used to purchase a wide range of investments. The brokerage facilitates these transactions, often charging fees or commissions, although many firms now offer commission-free trading on certain products. Accounts can be taxable or tax-advantaged, such as individual retirement accounts (IRAs), which offer specific benefits for long-term saving.

Key Features to Consider

Choosing a brokerage account involves more than comparing fees. Here are some important factors to keep in mind:

Fees and Costs

While many brokerages offer commission-free trades, other costs, such as account maintenance fees or margin interest, may apply. Understanding the fee structure can help you avoid surprises.Investment Options

Different brokerages offer varying levels of access to stocks, bonds, ETFs, mutual funds, and alternative investments. Ensure the platform aligns with the type of investments you’re interested in.Trading Tools and Platforms

User-friendly platforms can make a big difference, especially for beginners. Advanced traders may prioritize platforms with robust charting tools, research capabilities, and customizable options.Account Types

Determine whether you need a standard taxable account, a retirement-focused account like a Roth IRA, or a specialized account for education savings.Customer Support and Education

Many brokerages offer educational resources, webinars, and 24/7 customer support to assist with investment decisions or technical issues.

Who Are Brokerage Accounts For?

Brokerage accounts are suitable for a variety of investors, from those just starting to build wealth to experienced traders managing complex portfolios. They offer flexibility in managing investments, making them an essential tool for anyone looking to participate in the financial markets.

Regulatory Protections

U.S. brokerage accounts are regulated by entities like the Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA), ensuring that firms operate transparently and in the best interests of their clients. Additionally, most accounts are protected by the Securities Investor Protection Corporation (SIPC), which covers up to $500,000 in securities and cash in the event of a brokerage failure (though it does not protect against market losses).

Important Note

Before opening a brokerage account, it’s crucial to verify all terms, fees, and features directly with the provider. While this page aims to present accurate and up-to-date information, brokerage policies and offerings can change over time. Confirming the details with the provider ensures that the account aligns with your financial needs and expectations.

Compare Fees

Explore Features

Last Updated: March 7, 2025

Some of the links on this page are affiliate links, meaning we may earn a commission if you click through and make a purchase, at no extra cost to you. This does not influence our comparisons or reviews, which are based on our independent research and analysis. All content on this page is for educational purposes only and should not be considered financial advice. Always verify details directly with the provider before making any decisions. Full disclosure Here.

The information provided on this page is for educational purposes only and does not constitute financial, investment, or legal advice. We do not guarantee the accuracy, completeness, or timeliness of the information presented. All investments involve risk, including the loss of principal, and past performance does not guarantee future results. You should consult with a licensed financial advisor or other qualified professional to assess your individual circumstances before making any investment decisions.

Interactive Brokers (IBKR)

Fees:

- Stocks/ETFs (IBKR Lite): $0 per share (for U.S. residents only)

- Stocks/ETFs (IBKR Pro): $0.0005 to $0.0035 per share, $0 on No Transaction Fee ETFs

- Options: $0.15 to $0.65 per contract

- Futures: $0.25 to $0.85 per contract

- Spot Currencies: 0.08 to 0.20 basis points × trade value per order

- Bonds: 10 basis points × face value per order

- Mutual Funds: 3% x trade value up to $14.95 per transaction, $0 on No Transaction Fee Funds

Offer:

- Low commissions starting at $0.04 with no added spreads, ticket charges, or platform fees

- Margin rates up to 53% lower than the industry average

- Earn high interest rates on available cash (up to 3.83%)

- Stock Yield Enhancement Program allows clients to earn extra income on lendable shares

Trading Platforms:

- IBKR GlobalTrader

- Trader Workstation (TWS)

- MetaTrader 5

- Global Market Access: IBKR provides access to over 150 global markets for trading stocks, options, futures, currencies, bonds, and funds.

- Low Fees: Offers competitive pricing with no added spreads, ticket charges, platform fees, or account minimums.

- Advanced Trading Tools: Features IBKR BestX™ and supports over 90 order types, catering to diverse trading strategies.

- Award-winning trading platforms for desktop, web, and mobile

- Access to global markets with multi-currency funding

- Advanced trading tools and analytics to support portfolio management

- Comprehensive reporting with real-time trade confirmations and transaction cost evaluation

- Over 90 order types and algos for diverse trading strategies

- Secure brokerage with strong financials, conservative balance sheet, and excess regulatory capital

IBKR Desktop is an intuitive and powerful trading platform developed by Interactive Brokers, catering to both beginner and professional traders. It offers competitive pricing with low commissions, tight spreads, and access to global markets. With a strong focus on security, technology, and execution efficiency, IBKR provides a feature-rich experience, including sophisticated portfolio analysis tools and algorithmic trading. Clients can take advantage of its global investment opportunities, interest-earning capabilities, and robust trading infrastructure. Recognized by multiple industry awards, IBKR is an excellent choice for advanced traders looking for cost-effective, high-performance trading solutions.

- Low trading fees and commissions

- Access to 160 global markets across 36 countries

- Comprehensive trading platforms for mobile, web, and desktop

- Advanced research and trading tools, including free news and analytics

- Strong security measures and financial stability

- Platform complexity may require a learning curve for beginners

- Customer support response times can be slow during peak hours

- Some advanced features may not be available on IBKR Lite

View Terms & Conditions

Fidelity Investments

Fees:

- $0 commission for online U.S. stock, ETF, and options trades.

- $0.65 per options contract.

- $1 per bond or CD in secondary trading (free for U.S. Treasuries traded online).

- $0 for Fidelity mutual funds and select funds with no transaction fees.

Offer:

- $0 commission trades with no account fees or minimums to open a retail brokerage account, including IRAs.

- Industry-first Zero expense ratio index mutual funds.

Trading Platforms:

- Fidelity Mobile

- Active Trader Pro®

- MetaTrader 4/5

- TradingView

- $0 Commission Trading: Fidelity offers commission-free online U.S. stock, ETF, and options trading, making it cost-effective for investors.

- Wide Investment Options: Access to stocks, ETFs, mutual funds, options, fixed income, and international trading in 25 countries.

- Fractional Shares: The “Stocks by the Slice” feature enables purchasing fractional shares with as little as $1.

- Zero commissions on U.S. stocks, ETFs, and options.

- Zero expense ratio index funds exclusively from Fidelity.

- No account fees or minimums for brokerage and IRA accounts.

- Advanced trading tools and professional insights.

- Retirement and tax-smart investing solutions.

- Dedicated wealth management services with financial advisors.

- Robust security measures for account protection.

Fidelity Brokerage Services is a leading brokerage firm offering commission-free trading, retirement planning solutions, and personalized wealth management services. Investors can trade a variety of securities, including stocks, ETFs, mutual funds, bonds, and options. Fidelity’s Zero Expense Ratio Index Funds provide cost-effective investment opportunities, and their advanced trading tools help maximize returns. The firm also offers guidance through financial advisors for customized investment planning. Security and investor protection are top priorities, making Fidelity a trusted choice among traders and long-term investors.

- $0 commission on U.S. stock, ETF, and options trades.

- No account minimums to open a retail brokerage or IRA account.

- Industry-first zero expense ratio index funds.

- Comprehensive retirement solutions, including Roth IRA and Rollover IRA options.

- Advanced trading tools and professional investment insights.

- Dedicated financial advisors for wealth management.

- Strong security measures to protect investor assets.

- $0.65 per contract fee for options trading.

- Limited commission-free mutual funds outside Fidelity’s offerings.

- No futures or cryptocurrency trading available.

- Advisor services may require higher investment minimums.

View Terms & Conditions

Robinhood

Fees:

- Commission-Free Trading: No fees for U.S. stocks, ETFs, and options trades.

- Robinhood Gold: $5 per month for access to premium features, including margin trading and professional research.

- Crypto Fees: Although crypto trading is commission-free, users should be aware that cryptocurrencies held through Robinhood are not protected by FDIC or SIPC insurance.

Offer:

- Referral Offer: A referral program is available, providing rewards for referring new users to the platform.

Trading Platforms:

- Mobile App

- Robinhood Legend

- MetaTrader 4/5

- TradingView

- Commission-Free Trading: Robinhood offers $0 trading fees for U.S. stocks, ETFs, options, and cryptocurrencies.

- Fractional Shares: Users can start investing with as little as $1, making high-priced stocks accessible.

- Educational Resources: Robinhood Learn provides tools and insights for both beginner and experienced investors.

- Commission-Free Trading: Robinhood offers commission-free trading for U.S. stocks, ETFs, and options, making it highly attractive to retail investors.

- Fractional Shares: Users can invest in fractional shares, allowing them to start with as little as $1, which makes high-priced stocks accessible.

- Cryptocurrency Trading: Offers commission-free trading of popular cryptocurrencies, including Bitcoin (BTC), Ethereum (ETH), Dogecoin (DOGE), Shiba Inu (SHIB), and more.

- Cash Card: Robinhood provides a prepaid cash card through Sutton Bank, offering FDIC-insured spending accounts.

- Robinhood Gold: A premium subscription-based service providing advanced features like margin investing and access to professional research reports for a monthly fee.

- Robinhood Learn: A comprehensive educational platform to help new and experienced traders improve their investing knowledge.

- Protection and Security: The platform offers multi-factor authentication, 24/7 account monitoring, and account protection from unauthorized activity.

Robinhood is a popular online brokerage that pioneered commission-free trading, offering users access to a variety of investment products, including stocks, ETFs, options, and cryptocurrencies. The platform caters to both beginners and experienced investors, providing fractional share trading, cryptocurrency trading, and access to advanced financial tools through Robinhood Gold. Known for its user-friendly mobile app, Robinhood has reshaped how retail investors engage with the stock market.

- Commission-Free Trading: No fees on U.S. stock, ETF, options, and crypto trades, making investing more affordable.

- Fractional Shares: Users can buy fractions of stocks, enabling them to diversify their portfolios with small investments.

- Cryptocurrency Trading: Robinhood offers access to a wide range of cryptocurrencies without additional fees.

- Easy-to-Use Platform: The mobile and web platforms are intuitive and user-friendly, making it accessible for beginners.

- Protection and Insurance: Robinhood offers multi-factor authentication and protection against unauthorized account activity.

- Limited Advanced Trading Features: While great for beginners, professional traders may find Robinhood lacking in advanced tools compared to other platforms.

- Margin Investing Risks: Robinhood Gold includes margin investing, which can lead to significant losses if not managed properly.

View Terms & Conditions

eToro

Fees:

- Account opening fee: Free

- Management fees: Free

- Withdrawal fee: Free or $5 (depending on account currency)

- Minimum withdrawal amount: $30 (USD accounts), no minimum for GBP/EUR accounts

- Inactivity fee: $10/month after 12 months of inactivity

- Stock commission fees: $1 or $2 per trade, based on residence and exchange

- Other fees apply (such as spreads on trades)

Offer:

- Earn up to 4.55% interest annually on balance with no commitment

- Free $100,000 virtual portfolio to practice trading

- Discounts or exemptions on fees for eToro Club members

Trading Platforms:

- Social Trading: eToro’s CopyTrader™ allows users to replicate the trades of successful investors.

- Diverse Assets: Access to over 6,000 instruments, including stocks, ETFs, crypto, and forex.

- Commission-Free Trading: Offers $0 commission on U.S. stock trades, appealing to retail investors.

- Social trading with CopyTrader™

- Crypto trading with 100+ digital assets

- Fractional shares for stock investments

- Multi-asset trading (stocks, forex, indices, ETFs, commodities)

- Leverage options for forex and indices (up to 1:30 for retail, 1:400 for professionals)

- Commission-free stock trading in select regions

- Interest on balance up to 4.55%

- Top-tier banking partners (J.P. Morgan, Deutsche Bank, etc.)

eToro is a global fintech leader known for its social trading and multi-asset investment platform. With over 35 million users worldwide, it provides access to a wide range of financial instruments, including stocks, ETFs, forex, indices, commodities, and cryptocurrencies. The CopyTrader™ feature enables investors to mirror the trades of successful traders, making it ideal for beginners. eToro also offers an educational platform and a $100,000 demo account for users to practice trading. Additionally, the platform rewards users with up to 4.55% interest on their balance and collaborates with top-tier banks for secure fund management.

- Social Trading: Enables users to copy the trades of experienced investors, making it easier for beginners to learn and invest.

- Wide Range of Assets: Offers a diverse selection of financial instruments, including stocks, cryptocurrencies, forex, and commodities.

- User-Friendly Interface: Intuitive platform design suitable for both novice and seasoned traders.

- No Commission on Stocks: Commission-free trading for stocks helps reduce overall trading costs.

- Spreads and Fees: While stock trading is commission-free, other assets like cryptocurrencies and forex have wider spreads and additional fees.

- Limited Research Tools: Compared to some other platforms, eToro offers fewer in-depth research and analysis tools.

- Withdrawal Fees: Charges a withdrawal fee, which can be a drawback for frequent withdrawals.

- Customer Support: Some users have reported slow response times from customer support.

View Terms & Conditions

Tastytrade

Fees:

- Options on Stocks and ETFs: $1.00 per contract to open, $0 to close (capped at $10 per leg).

- Futures Contracts: $1.25 per contract to open/close.

- Micro Futures Contracts: $0.85 per contract to open/close.

- Stocks and ETFs: No commission for unlimited shares.

- Cryptocurrency: No commission on trades, but a 35 basis point (bp) markup/markdown on the executed price is applied.

Offer:

- Cash Bonus: Receive a cash bonus on qualified deposits, based on the deposit amount.

Trading Platforms:

- Low-Cost Options Trading: TastyTrade offers $1.00 per contract to open options trades with no commission to close, capped at $10 per leg for equity options.

- Diverse Trading Instruments: Supports trading in stocks, ETFs, options, futures, micro futures, and cryptocurrencies, catering to varied market interests.

- Educational Resources and Tools: Provides free trading tutorials, platform demos, and advanced risk analysis tools for strategy development and decision-making.

- Low-Cost Options Trading: TastyTrade offers competitive rates for options trading, with a $1.00 per contract fee for opening options trades and no commission to close.

- Capped Commissions: For equity options, commissions are capped at $10 per leg, ensuring that costs are kept low even for high-volume traders.

- Wide Range of Trading Instruments: TastyTrade supports trading in stocks, ETFs, options, futures, micro futures, and cryptocurrencies, providing access to diverse markets.

- Advanced Trading Platform: Offers an intuitive, user-friendly platform designed to facilitate quick trade execution with advanced risk analysis tools.

- Educational Resources: TastyTrade provides free access to platform demos, trading tutorials, and financial education resources, helping traders develop their strategies.

- Cutting-Edge Risk Analysis Tools: Traders can benefit from advanced tools that help assess and manage risk, improving decision-making in volatile markets.

- No Fees on Cryptocurrency Trades: TastyTrade does not charge commissions on cryptocurrency trades, although it applies a markup/markdown on prices.

- No Account Minimums: There are no minimum deposit requirements to open or maintain an account, making it accessible for traders of all levels.

TastyTrade is a U.S.-based online brokerage platform designed for options traders and investors who want low-cost access to a variety of markets, including stocks, futures, and cryptocurrencies. Known for its user-friendly platform and capped commissions, TastyTrade caters to both beginner and advanced traders. The platform offers competitive fees for options trading, a simple yet powerful interface, and comprehensive educational resources, making it a strong choice for traders seeking to minimize fees while maximizing trading opportunities.

- Low Commissions on Options: Only $1.00 per contract to open an options trade, and no commission to close, making it ideal for active traders.

- Capped Commissions: For equity options, commissions are capped at $10 per leg, helping high-volume traders keep costs under control.

- Diverse Product Offering: Access to options, futures, micro futures, stocks, ETFs, and cryptocurrencies ensures that users can trade a wide range of assets.

- No Account Minimums: No minimum deposit requirement to open or maintain an account, allowing new traders to start with small amounts.

- Free Educational Resources: Offers comprehensive tutorials, trading strategies, and market insights to help traders improve their skills.

- Risky for Inexperienced Traders: Given its focus on options and futures, which involve leverage, TastyTrade may not be ideal for inexperienced traders unfamiliar with these instruments.

- Cryptocurrency Not FDIC or SIPC Insured: Cryptocurrencies traded through TastyTrade are not protected by FDIC or SIPC, adding an extra layer of risk for crypto traders.

View Terms & Conditions

E*TRADE From Morgan Stanley

Fees:

- $0 Commissions: No fees for U.S.-listed stock, ETF, and mutual fund trades.

- Options Fees: $0.65 per options contract (reduced to $0.50 for traders who make at least 30 trades per quarter).

- Futures Trading: $1.50 per contract, plus exchange fees.

- Managed Portfolios: E*TRADE’s Core Portfolios have an annual advisory fee of 0.30%, with a minimum balance of $500.

- Broker-Assisted Trades: $25 for trades placed through a broker.

Offer:

- Promotional Offer: New clients who open and fund an account by January 31, 2025, can receive up to $1,000 depending on the qualifying deposit.

- Minimum Deposit Required: A minimum deposit of $1,000 is required to qualify.

- Promo Code: Use promo code

OFFER24to take advantage of this offer.

Trading Platforms:

- Commission-Free Trading: $0 commissions on U.S.-listed stocks, ETFs, mutual funds, and options trades.

- Diverse Investment Options: Wide range of assets, including stocks, bonds, ETFs, mutual funds, and futures.

- Advanced Platforms: Offers ETRADE for general users and Power ETRADE with advanced tools for active traders.

- Commission-Free Trading: E*TRADE offers $0 commissions for online U.S.-listed stock, ETF, mutual fund, and options trades, making it highly appealing for retail investors.

- Wide Range of Investment Options: Users can invest in stocks, options, ETFs, mutual funds, bonds, CDs, futures, and prebuilt portfolios, providing extensive diversity for portfolio building.

- Multiple Platforms: ETRADE offers the standard ETRADE platform as well as Power E*TRADE, which includes advanced charting and technical analysis tools tailored to active traders.

- Core and Managed Portfolios: E*TRADE provides both core automated portfolios and professionally managed portfolios, with an annual advisory fee of 0.30% and a minimum balance of $500 for the Core Portfolio.

- Retirement Accounts: E*TRADE offers a variety of retirement accounts, including IRAs, Roth IRAs, and small business retirement plans.

- Research and Insights: Access to comprehensive market research and analysis through Morgan Stanley’s equity research services, along with timely insights and trading ideas.

- Advanced Trading Tools: Power E*TRADE delivers an advanced platform with robust trading tools, including options analytics, futures trading, and risk management tools.

ETRADE, now part of Morgan Stanley, is a well-established online brokerage offering a wide variety of investment products and services, including commission-free trading for U.S.-listed stocks, ETFs, and options. The platform caters to a broad range of investors, from beginners to active traders, with intuitive tools, powerful platforms, and in-depth research provided by Morgan Stanley. ETRADE’s advanced tools, along with its educational content and retirement planning resources, make it a one-stop platform for traders and investors of all levels.

- Commission-Free Trading: Offers $0 commissions on U.S.-listed stocks, ETFs, mutual funds, and options trades, which is highly beneficial for both casual and frequent investors.

- Powerful Trading Platforms: ETRADE’s platforms, including Power ETRADE, cater to both beginner and advanced traders, offering a variety of features such as risk analysis and technical charting.

- Diverse Investment Products: A wide selection of assets, including stocks, bonds, options, mutual funds, and futures, allows for diverse portfolio management.

- Comprehensive Research and Tools: Provides access to top-tier research from Morgan Stanley, as well as advanced trading tools for active traders.

- No Account Minimums: E*TRADE does not require an account minimum for its standard brokerage accounts.

- Options Trading Fees: While stock and ETF trades are commission-free, options trades incur a fee of $0.65 per contract (or $0.50 for active traders), which could add up for frequent options traders.

- Complexity for Beginners: The advanced tools and research may be overwhelming for new investors who may not need all the functionalities offered.

- Fees on Broker-Assisted Trades: Trades placed through a broker incur a $25 fee, which could be costly for users who prefer hands-on support.

View Terms & Conditions

Plus500

Fees:

- Commissions: $0.89 for standard & E-Mini contracts, $0.49 for micro contracts.

- Liquidation Fee: $10 per contract.

- Withdrawal/Deposit Fees: No fees for wire transfers, deposits, or withdrawals.

- Other Fees: No platform, data, or routing fees. No inactivity fee.

Offer:

- Trading Bonus for New Users: New users can receive a bonus based on their initial deposit, ranging from $20 for a $100 deposit up to $200 for a $10,000 deposit.

- Bonus Usage: The bonus is applied to cover trading commissions and fees.

Trading Platforms:

- Global Market Access: Offers futures trading across diverse markets, including crypto, forex, energy, and equity indices.

- User-Friendly Platform: Simplified trading experience tailored for beginners, with a free demo account to practice strategies.

- Low Commissions: No platform or market data fees, with cost-effective trading commissions.

- Global Market Access: Plus500 offers futures trading across various markets, including crypto, agriculture, metals, forex, interest rates, energy, and equity indices.

- Low Commissions: No platform or market data fees, and trading commissions are designed to be cost-effective.

- Easy to Use: The platform is tailored for beginners and retail clients, with a user-friendly app that simplifies futures trading.

- Free Demo Account: Users can try out trading strategies with live quotes without risking real money through a demo account.

- Flexible Account Setup: Start trading with as little as $100 and scale up when ready.

- Educational Resources: Plus500 offers a Futures Academy with educational content like articles and videos to help traders learn the ins and outs of futures trading.

- 24/7 Support: Customer support is available round the clock to assist users with their trading needs.

Plus500 is a globally recognized platform for futures trading, offering a wide range of instruments including futures on equity indices, crypto, metals, forex, and more. The platform focuses on ease of use and low commissions, making futures trading accessible to both beginners and more experienced traders. Backed by over 20 years of experience, Plus500 provides professional customer support and emphasizes security by keeping client funds in segregated accounts. Plus500 is listed on the London Stock Exchange and is a full member of the CME Group and the National Futures Association (NFA).

- No Platform or Market Data Fees: Users enjoy low commissions without the burden of platform or data fees.

- Beginner-Friendly: Designed for ease of use, even for traders new to futures.

- Global Market Coverage: Offers access to a wide range of futures across different asset classes and markets.

- Free Demo Account: The demo account allows users to test strategies without risking real funds.

- Low Minimum Deposit: Start trading with just $100, making the platform accessible for new traders.

- Limited Asset Types: The platform focuses primarily on futures and does not cater to other traditional investment products like stocks or bonds.

View Terms & Conditions

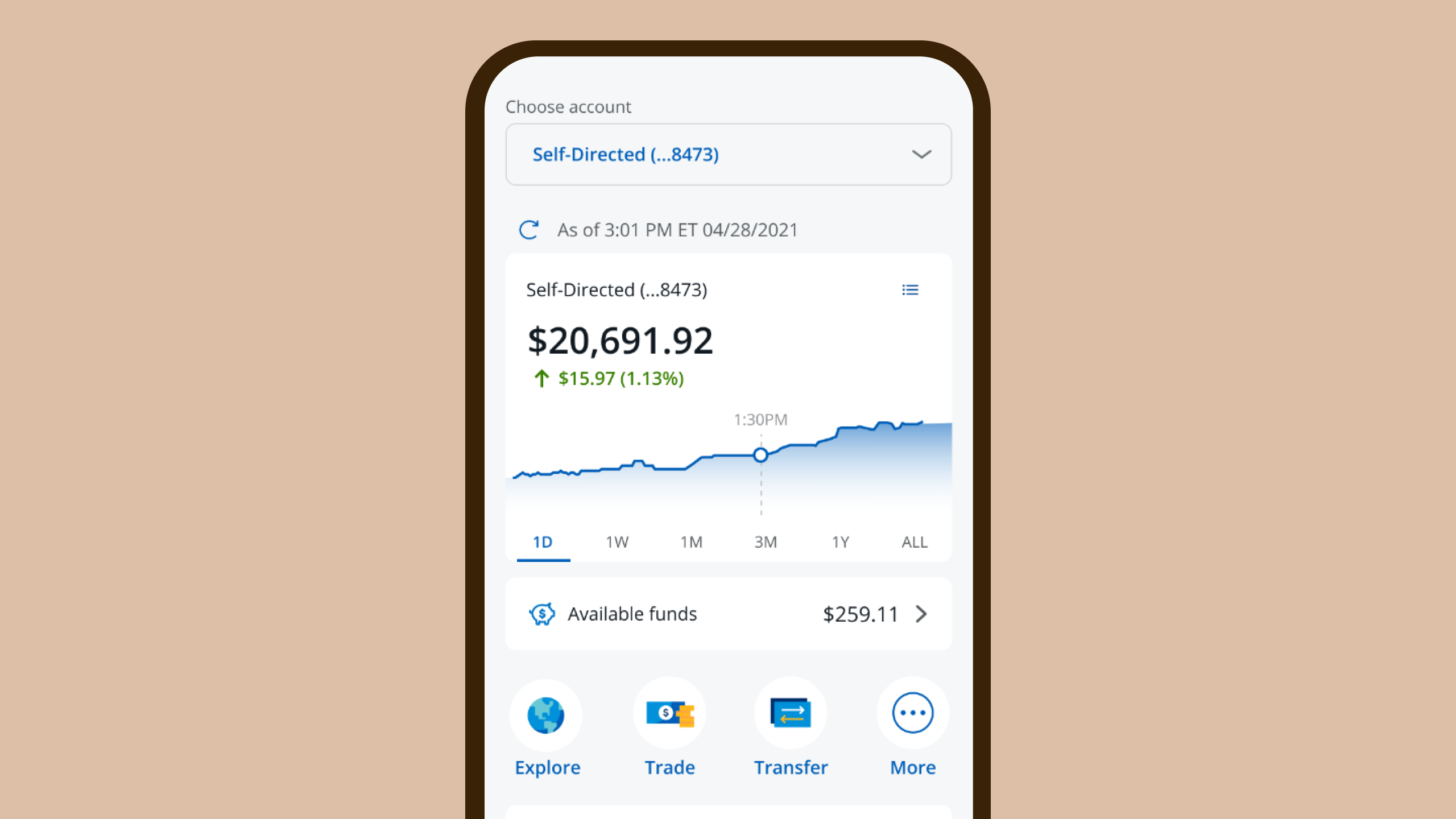

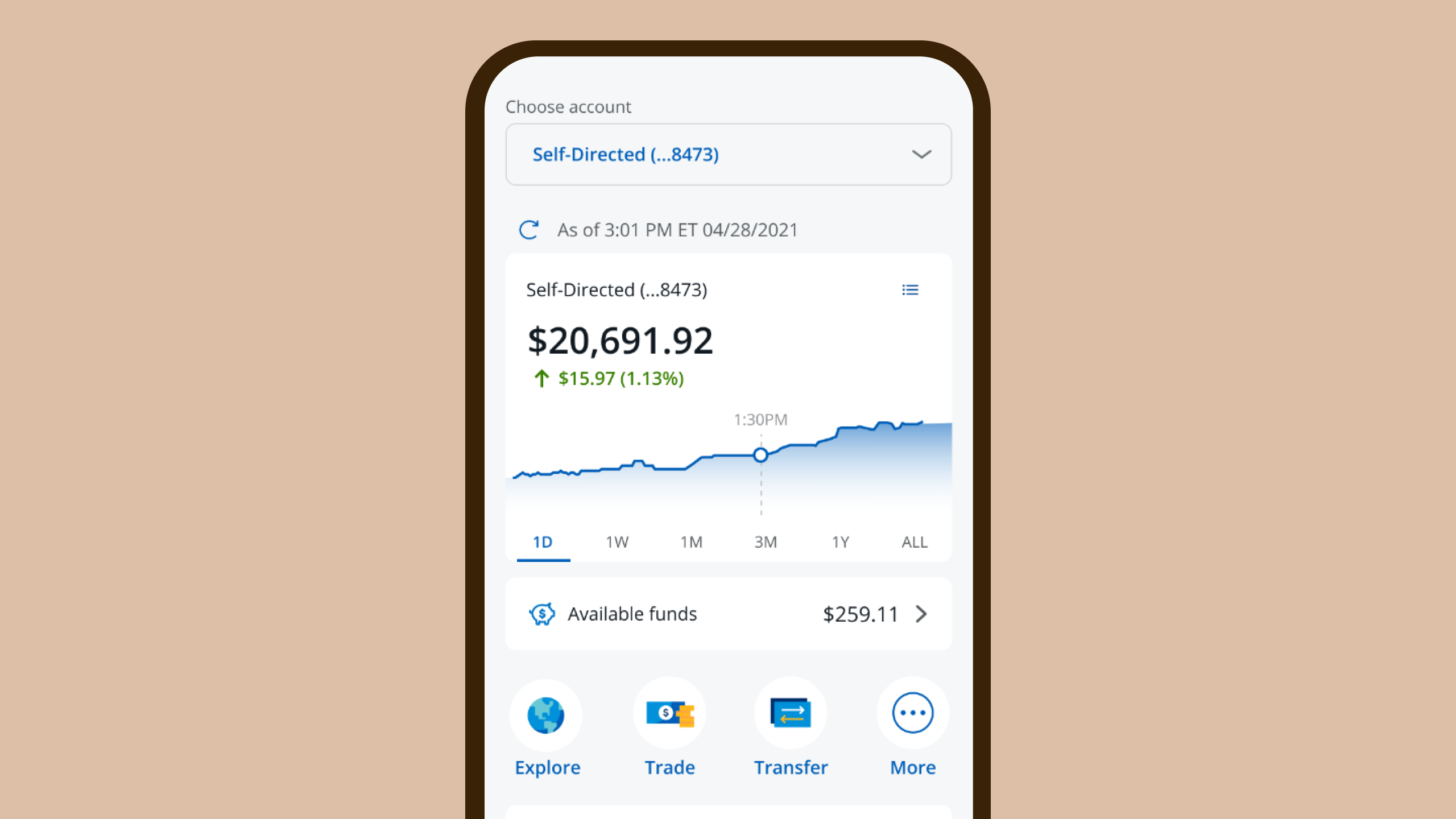

J.P. Morgan Self-Directed Investing

Fees:

- Stocks/ETFs: $0 online commission; $25 call-in fee. U.S. listed trades have a small regulatory transaction fee ($0.01-$0.03 per $1,000 principal).

- Options: $0 online base + $0.65 per contract; $25 call-in fee + $0.65 per contract.

- Mutual Funds: $0 online; $20 call-in.

- Bonds: $10 per trade + $1 per bond (up to $250).

- Other Fees: $75 for account transfers/closures; $25 wire transfer; $10 overnight mail.

Offer:

- New Customer Bonus: Receive up to $700 when you open and fund a J.P. Morgan Self-Directed Investing account by January 23, 2025.

- Bonus Tiers:

- $50 bonus for deposits between $5,000 and $24,999.

- $150 bonus for deposits between $25,000 and $99,999.

- $325 bonus for deposits between $100,000 and $249,999.

- $700 bonus for deposits of $250,000 or more.

Trading Platforms:

- Commission-Free Trading: Unlimited $0 online trades for U.S.-listed stocks, ETFs, and options, with a $0.65 per contract fee for options.

- Comprehensive Investment Options: Access to stocks, ETFs, mutual funds, options, fixed income products, and retirement accounts like IRAs.

- Wealth Management Tools: Features like the J.P. Morgan Wealth Plan® and market insights to help manage investments with personalized strategies.

- Commission-Free Trading: J.P. Morgan offers unlimited $0 commission online trades for U.S.-listed stocks, ETFs, and options. Options trades have a $0.65 per contract fee.

- Account Options: Provides access to a variety of account types, including general investment accounts and retirement accounts (Traditional and Roth IRAs).

- Investment Products: Users can invest in stocks, ETFs, mutual funds, options, and fixed income products.

- Wealth Management Tools: Includes the J.P. Morgan Wealth Plan®, which gives a 360-degree view of finances, helping users manage their investments with personalized insights.

- Mobile and Online Access: Investors can manage their portfolios easily through Chase Mobile® and the J.P. Morgan website, with access to educational resources and market commentary.

- Retirement Planning: Supports retirement planning with account rollovers, traditional and Roth IRAs, and tools like the 401K/IRA calculators.

- Market Insights: Provides market commentary and research from J.P. Morgan specialists to help users stay informed and make strategic investment decisions.

J.P. Morgan Self-Directed Investing is an online platform that offers commission-free trading for U.S.-listed stocks, ETFs, and options, making it an attractive choice for investors who want control over their portfolios. It provides access to general investment accounts and retirement accounts, including Traditional and Roth IRAs. The platform features tools for comprehensive wealth management and retirement planning, supported by market insights from J.P. Morgan specialists. Investors can easily manage their portfolios through the Chase Mobile® app and online, with seamless integration for J.P. Morgan customers.

- Commission-Free Trading: Unlimited $0 commission on U.S. stocks and ETFs makes it cost-effective for active traders.

- Diverse Investment Products: Offers a broad range of investment options, including mutual funds, fixed income, and options.

- Comprehensive Wealth Tools: The J.P. Morgan Wealth Plan provides personalized insights and helps track financial goals.

- Integration with Chase: Convenient integration with Chase’s mobile and online banking platforms makes managing investments and banking seamless.

- Retirement Planning Support: Provides a variety of retirement accounts and tools for planning and managing retirement savings.

- Options Trading Fees: While stock and ETF trades are commission-free, options trades incur a $0.65 per contract fee.

- Limited Features for Advanced Traders: Professional traders may find the platform lacks some advanced tools and features available on specialized trading platforms.

- Account Minimum for Advisory Services: Managed services with J.P. Morgan advisors require a minimum investment of $25,000.

View Terms & Conditions

Charles Schwab

Fees:

- Online U.S. Stock, ETF, and Options Trades: $0 commission.

- Options: A $0.65 per contract fee applies to options trades.

- Broker-Assisted Trades: $25 per trade.

- OTC Trades: $6.95 for online trades; additional fees for phone or broker-assisted transactions.

- Foreign Stock Transactions: $50 for online OTC trades, with higher fees for broker-assisted trades (greater of $100 or 0.75% of the principal).

Offer:

- No Active Offer: Currently, there are no promotional offers available.

Trading Platforms:

- Commission-Free Trades: $0 commission on online U.S.-listed equities, ETFs, and options trades.

- Diverse Investment Options: Access to stocks, options, bonds, mutual funds, and ETFs with no account minimums.

- Advanced Platforms and Tools: Offers web, mobile, and software platforms with advanced trading and planning features.

- Commission-Free Trades: Schwab offers $0 commission on online listed equity trades, ETFs, and options trades in the U.S.

- Account Flexibility: You can open individual or joint brokerage accounts with no account minimums and no opening or maintenance fees.

- Diverse Investment Options: Schwab provides access to a wide range of financial products, including stocks, options, bonds, mutual funds, and ETFs.

- Advanced Trading Platforms: Schwab offers web, software, and mobile platforms with advanced tools for managing your brokerage account and making trades.

- Research and Planning Tools: Schwab offers online tools to help you screen, evaluate, and plan your investments, providing comprehensive research options.

- 24/7 Support: Access Schwab’s financial professionals anytime by phone or at one of 300+ physical branches.

- Trading Education: Schwab offers extensive educational resources to help users grow their trading skills, including access to trading specialists.

Charles Schwab offers a broad array of financial services and investment options, catering to both individual and institutional clients. Its advanced trading platforms and tools support a wide range of securities, while its financial advisory services help clients plan for retirement and other financial goals. Schwab also provides extensive educational resources and market research, ensuring that clients have the information they need to make informed investment decisions. The firm emphasizes low-cost trading with $0 commissions on select trades.

- $0 Commission on Listed U.S. Stocks, ETFs, and Options: Provides cost-effective trading for individual investors.

- No Account Minimums: Schwab allows users to open and maintain accounts without any minimum deposit requirements.

- Diverse Product Offering: Access to a variety of investment products, including equities, bonds, mutual funds, and options.

- Advanced Trading Tools: Users can take advantage of Schwab’s powerful trading platforms across devices.

- Comprehensive Support: Schwab provides 24/7 phone support and access to 300+ branches for in-person assistance.

- Educational Resources: Schwab offers trading education and access to specialists, making it ideal for investors looking to expand their knowledge.

- Fees for Non-Listed Securities: Online OTC trades cost $6.95, and broker-assisted trades are subject to a $25 fee.

- Foreign Stock Fees: Foreign stock transactions carry a higher cost, with broker-assisted trades costing the greater of $100 or 0.75% of the principal.

- Broker-Assisted and Automated Phone Trades: Broker-assisted trades incur a $25 fee, and trades made via automated phone are charged $5.

View Terms & Conditions

Webull

Fees:

- Stock and ETF Trading: No commission fees on U.S.-listed stocks and ETFs.

- Options: A $0.55 per contract fee applies to certain index options trades, and regulatory fees may apply.

- Regulatory and Exchange Fees:

- SEC: $0.0000278 per trade amount (minimum $0.01).

- FINRA: $0.000166 per share for each equity sale (maximum $8.30 per trade).

- Over-the-Counter (OTC) Trading: Additional fees for trading low-priced securities and foreign stocks via ADRs. For transactions over 100,000 shares priced under $1.00 per share, the fee is $0.0002 per share.

Offer:

Free Fractional Shares: Webull offers up to 75 free fractional shares when users deposit between $500 and $25,000 and maintain it for 30 days.

Transfer Bonuses: Earn a 2.0% cash bonus when you transfer non-IRA investments to Webull, and a 3.5% bonus on IRA transfers.

Futures Promotion: Deposit $500 and trade 50 contracts in the first 3 months to get commission-free trades on those contracts and free CME Group Level 2 Market Data for 3 months.

Trading Platforms:

- Commission-Free Trading: Zero fees for U.S.-listed stocks, ETFs, and options trades, including intra-day margin and short-selling.

- Advanced Platforms: Offers customizable tools, real-time quotes, and extended hours trading via Webull Desktop 8.0.

- Diverse Investment Options: Trade stocks, ETFs, options, ADRs, fractional shares, and futures, including Money Market Funds.

- Commission-Free Trading: Webull offers commission-free trading for U.S.-listed stocks, ETFs, and options, with no fees for intra-day margin or short-selling trades.

- Advanced Trading Platforms: Webull provides a desktop app (Webull Desktop 8.0) with customizable, advanced charting tools, real-time quotes, and extended market hours trading (4 AM-9:30 AM ET and 4 PM-8 PM ET).

- Wide Investment Options: Investors can trade a variety of products, including stocks, ETFs, options, ADRs, and fractional shares. Webull has also introduced Money Market Funds and offers futures trading on indices, crypto, and other assets.

- IRAs and Retirement Accounts: Webull offers Traditional, Roth, and Rollover IRAs with investment services that include cash management and robo-advisors.

- Community and Paper Trading: Webull has a community feature where users can share ideas, and it offers paper trading, allowing investors to test strategies without risking real money.

- New Features: Money Market Funds have recently been introduced, and Webull’s futures trading covers indices, cryptocurrencies, and FX, among others.

Webull is a commission-free online brokerage that offers U.S. stock, ETF, and options trading without fees, making it ideal for retail investors. With advanced trading tools, extensive research features, and support for fractional shares, Webull is designed to be user-friendly while also offering comprehensive features for more experienced traders. The platform is available on desktop, mobile, and web, with a focus on providing a seamless experience across all devices. Webull also supports a variety of IRAs and retirement accounts, making it a versatile platform for both short-term and long-term investment strategies.

- Commission-Free Trading: Zero commission on U.S.-listed stocks, ETFs, and options trades makes it highly attractive to cost-conscious investors.

- Advanced Tools for Traders: Webull offers robust charting, analysis tools, and extended hours trading for active traders.

- Fractional Shares: Allows users to buy fractions of stocks, making high-priced shares accessible to small investors.

- No Minimum Deposit: You can open and trade with Webull without needing a minimum deposit.

- Community and Paper Trading: Users can engage with other investors and test strategies through Webull’s paper trading feature.

- Promotions and Bonuses: Webull offers attractive promotions, including free fractional shares for deposits and transfer bonuses for IRAs.

- Higher Fees for Some Services: While stock and ETF trades are commission-free, options trades have a contract fee, and there are transfer-out fees for moving stock out of Webull.

View Terms & Conditions

Ally Invest

Fees:

- Stocks and ETFs: No commission for U.S.-listed stocks and ETFs.

- Options: $0.50 per contract fee, which is relatively low compared to other platforms.

- Bonds: Bonds can be purchased for $1 per bond, with a minimum transaction of $0.

- Low-Priced Securities: A $4.95 base commission and $0.01 per share for stocks priced under $2.

- Personal Advice: For personalized financial advice, the fee is 0.85% per year, with a minimum balance of $100,000 required to access this service.

Offer:

- No Active Offer: Currently, there are no promotional offers available.

Trading Platforms:

- Commission-Free Trading: $0 commissions on U.S.-listed stocks, ETFs, and options trades, appealing to cost-conscious investors.

- Automated and Self-Directed Options: Offers Robo Portfolios for hands-off investing and self-directed trading with no account minimums.

- Integration with Ally Bank: Seamless management of savings and investments with easy transfers.

- Commission-Free Trading: Ally Invest offers $0 commissions on most U.S.-listed stocks, ETFs, and options trades, making it highly attractive for cost-conscious investors.

- Automated Investing: For those who prefer a hands-off approach, Ally provides Robo Portfolios, which can be tailored to specific goals and risk levels. A $100 minimum investment is required to start, and there is no advisory fee if you choose the cash-enhanced portfolio option.

- Self-Directed Trading: Investors who want to control their own investments can choose from a variety of assets, including stocks, ETFs, bonds, and options. No account minimum is required to start.

- Personalized Financial Advice: Ally offers personalized advice for higher-balance investors (starting at $100,000), which includes one-on-one guidance and a customized financial plan. There is a blended advisory fee of up to 0.85%.

- Education and Tools: Ally provides comprehensive educational resources, including articles and videos on topics like ETFs, mutual funds, and general investing tips. Charts, screeners, and expert analysis are available to assist in decision-making.

- Integration with Ally Bank: The platform integrates with Ally Bank, allowing users to manage their savings and investments in one place with easy money transfers.

Ally Invest is an online brokerage service offering a range of investment options, including commission-free stock, ETF, and options trading. The platform caters to different types of investors, from those looking for self-directed trading to those who prefer automated investing or personalized advice. Ally Invest stands out for its no-account-minimum policy, competitive pricing, and integration with Ally Bank, allowing users to manage both banking and investing in one view. With a user-friendly interface and robust educational resources, Ally Invest aims to make investing accessible to all levels of investors.

- No Commission on U.S.-Listed Securities: Ally Invest offers commission-free trading for most U.S.-listed stocks, ETFs, and options, reducing costs for active traders.

- No Account Minimum: Investors can start with as little as $0, making it easy for beginners to start investing.

- Automated Portfolios Available: For investors who prefer a hands-off approach, the Robo Portfolios option allows for automated, goal-based investing with a low minimum requirement of $100.

- Integrated with Ally Bank: Users can manage their savings and investments together, offering convenience for existing Ally Bank customers.

- Low Fees for Options: Options trading is offered with a competitive fee of $0.50 per contract.

- Comprehensive Educational Resources: Ally Invest provides accessible and easy-to-understand resources to help investors build their knowledge base.

- Limited Advanced Trading Features: While Ally offers basic trading tools, professional traders might find the platform lacking in sophisticated features available on more advanced trading platforms.

- Advisory Services Require High Minimum Balance: Personalized financial advice requires a minimum investment of $100,000, which may not be accessible to small investors.

- Limited Mutual Fund Selection: No-load mutual funds are available commission-free, but the selection may not be as extensive as competitors.

View Terms & Conditions

Merrill Edge

Fees:

- $0 Commissions: There are no commissions for U.S.-listed stock and ETF trades made online.

- Options Fees: Online options trades cost $0.65 per contract. Broker-assisted options trades cost $29.95 per trade plus $0.65 per contract.

- Mutual Funds: No load, no transaction fee (NTF) funds are free to trade online, but transaction fee funds incur a fee of $19.95 per online transaction.

- Advisory Fees:

- Merrill Guided Investing has a 0.45% annual fee.

- Merrill Guided Investing with an Advisor has a 0.85% annual fee.

- Account Transfer Fees: Full account transfers have a $49.95 fee.

Offer:

- No Active Offer: Currently, there are no promotional offers available.

Trading Platforms:

- Commission-Free Trading: Unlimited $0 online trades for stocks and ETFs with no balance minimums.

- Integration with Bank of America: Combines banking and investing with rewards programs and seamless transfers.

- Sustainable Investing: Offers ESG-focused options to align portfolios with personal values.

- Commission-Free Trading: Merrill Edge offers unlimited $0 online trades for stocks and ETFs with no trade or balance minimums.

- Account Options: The platform provides several account types, including individual, joint brokerage, custodial, and trust accounts. Retirement options such as IRAs are also available.

- Managed Investing Options: Merrill offers both self-directed investing and managed portfolio services through Merrill Guided Investing, with the latter involving an annual fee and professional portfolio management.

- Integration with Bank of America: Merrill Edge integrates with Bank of America, offering perks like combined banking and investment accounts, rewards programs, and seamless money transfers.

- Mobile Investing: Merrill Edge offers a mobile app that allows users to trade, monitor investments, and manage their accounts on the go.

- Sustainable Investing: Merrill provides ESG (Environmental, Social, Governance) investment options, allowing investors to align their portfolios with personal values.

Merrill Edge is an online brokerage offering commission-free trading for U.S.-listed stocks and ETFs, integrated with Bank of America for seamless banking and investing. It provides self-directed investing tools for those who want to manage their portfolios independently, as well as managed investing services for those seeking professional guidance. Merrill’s platform is designed to cater to both new and experienced investors, with an array of account types, easy-to-use tools, and an intuitive mobile app for managing investments.

- Unlimited Commission-Free Trades: Users can trade U.S.-listed stocks and ETFs with $0 commissions, which helps reduce costs for frequent traders.

- Integration with Bank of America: Combines banking and investing, offering seamless account management and the ability to benefit from the Preferred Rewards program.

- Comprehensive Investment Options: Access to stocks, ETFs, bonds, mutual funds, and more, along with ESG-focused investing options.

- Managed Portfolio Services: Merrill offers both guided investing with and without the help of an advisor, providing flexibility based on the user’s level of involvement and financial goals.

- Educational Tools: The platform provides research, insights, and educational content to help investors make informed decisions.

- Fees for Broker-Assisted Trades: Broker-assisted trades incur a fee of $29.95 per trade, which can be costly for users who prefer personalized assistance.

- Management Fees for Advisory Services: Merrill Guided Investing has an annual fee of 0.45%, while Merrill Guided Investing with an Advisor incurs a 0.85% fee, which could be higher than some competitors.

View Terms & Conditions

Frequently Asked Questions

A brokerage account is an investment account that allows you to buy and sell a variety of investments, such as stocks, bonds, mutual funds, and ETFs. Brokerage accounts are offered by brokerage firms, and the firm acts as an intermediary between you and the stock market.

Choosing a brokerage account depends on your investment goals, experience level, and the types of assets you want to trade. Consider factors like commission fees, account minimums, trading platforms, research tools, and customer service when making your decision.

Common fees include trading commissions, account maintenance fees, inactivity fees, and fees for additional services like wire transfers or paper statements. It’s essential to review the fee structure of a brokerage before opening an account to understand the total cost of investing.

Comparing broker accounts is useful because it helps you find the best fit for your investment needs and goals. Different brokers offer varying features, fee structures, and levels of service. By comparing options, you can identify a broker that offers the best combination of low fees, robust tools, excellent customer service, and the specific features you need for your trading strategy.

Some broker accounts are better than others because they offer superior features, lower costs, better customer support, or more comprehensive research tools. The best broker for you depends on your individual needs, such as whether you are a beginner looking for educational resources or an advanced trader needing sophisticated trading platforms. Evaluating factors like commission rates, ease of use, account minimums, and the availability of different investment products can help determine which broker is superior for your situation.

Common features of broker accounts include:

- Trading Platforms: Tools and software for executing trades and analyzing the market.

- Commission Rates: Fees charged for buying and selling securities.

- Account Minimums: The minimum amount required to open or maintain an account.

- Research and Educational Resources: Access to market research, news, and educational content.

- Customer Support: Availability of support through phone, email, or live chat.

- Investment Options: Variety of assets available for trading, such as stocks, bonds, ETFs, options, and cryptocurrencies.

To evaluate broker accounts, consider the following steps:

- Read Reviews: Look for customer reviews and expert analyses on financial websites and forums.

- Compare Fees: Check the commission rates, account maintenance fees, and any other charges.

- Test Platforms: If possible, use demo accounts or trial versions to test the trading platforms.

- Assess Customer Service: Contact customer support to evaluate their responsiveness and helpfulness.

- Review Resources: Examine the educational and research tools provided to ensure they meet your needs.

- Check Regulation: Ensure the broker is regulated by a reputable financial authority to safeguard your investments.

What to look for?

Here are some tips and important information to consider when choosing a brokerage account.

What are popular commission-free brokers in the US?

Robinhood, Webull, and E*TRADE offer commission-free trading on stocks, ETFs, and options. Robinhood is known for its user-friendly platform and cryptocurrency trading, while Webull provides advanced charting tools and extended trading hours. E*TRADE offers a more comprehensive platform with additional tools for retirement planning and market analysis.

Which brokers are best for beginner investors?

For beginners, Robinhood and Fidelity Investments are ideal due to their intuitive platforms and easy-to-navigate interfaces. Robinhood is great for those looking to trade with minimal fees, while Fidelity offers extensive educational resources and financial planning tools, making it a solid choice for long-term investors.

What are the best brokers for advanced traders?

Advanced traders may prefer Interactive Brokers (IBKR), Charles Schwab, and Tastytrade. IBKR offers low commissions, global market access, and advanced trading tools, while Charles Schwab provides sophisticated platforms like StreetSmart Edge® with comprehensive market research. Tastytrade stands out for options and futures trading with educational content for active traders.

What are popular brokers for retirement planning?

For retirement planning, Fidelity Investments, Charles Schwab, and Merrill Edge provide excellent options. All three offer a variety of account types like Traditional and Roth IRAs, along with tools for retirement savings and planning. Fidelity is known for its low fees and extensive retirement services, while Merrill Edge integrates seamlessly with Bank of America accounts for streamlined fund transfers.

Summary

Interactive Brokers (IBKR)

IBKR Desktop is an intuitive and powerful trading platform developed by Interactive Brokers, catering to both beginner and professional traders. It offers competitive pricing with low commissions, tight spreads, and access to global markets. With a strong focus on security, technology, and execution efficiency, IBKR provides a feature-rich experience, including sophisticated portfolio analysis tools and algorithmic trading. Clients can take advantage of its global investment opportunities, interest-earning capabilities, and robust trading infrastructure. Recognized by multiple industry awards, IBKR is an excellent choice for advanced traders looking for cost-effective, high-performance trading solutions.

Fidelity Investments

Fidelity Brokerage Services is a leading brokerage firm offering commission-free trading, retirement planning solutions, and personalized wealth management services. Investors can trade a variety of securities, including stocks, ETFs, mutual funds, bonds, and options. Fidelity’s Zero Expense Ratio Index Funds provide cost-effective investment opportunities, and their advanced trading tools help maximize returns. The firm also offers guidance through financial advisors for customized investment planning. Security and investor protection are top priorities, making Fidelity a trusted choice among traders and long-term investors.

Robinhood

Robinhood is a popular online brokerage that pioneered commission-free trading, offering users access to a variety of investment products, including stocks, ETFs, options, and cryptocurrencies. The platform caters to both beginners and experienced investors, providing fractional share trading, cryptocurrency trading, and access to advanced financial tools through Robinhood Gold. Known for its user-friendly mobile app, Robinhood has reshaped how retail investors engage with the stock market.

eToro

eToro is a global fintech leader known for its social trading and multi-asset investment platform. With over 35 million users worldwide, it provides access to a wide range of financial instruments, including stocks, ETFs, forex, indices, commodities, and cryptocurrencies. The CopyTrader™ feature enables investors to mirror the trades of successful traders, making it ideal for beginners. eToro also offers an educational platform and a $100,000 demo account for users to practice trading. Additionally, the platform rewards users with up to 4.55% interest on their balance and collaborates with top-tier banks for secure fund management.

Tastytrade

TastyTrade is a U.S.-based online brokerage platform designed for options traders and investors who want low-cost access to a variety of markets, including stocks, futures, and cryptocurrencies. Known for its user-friendly platform and capped commissions, TastyTrade caters to both beginner and advanced traders. The platform offers competitive fees for options trading, a simple yet powerful interface, and comprehensive educational resources, making it a strong choice for traders seeking to minimize fees while maximizing trading opportunities.

E*TRADE From Morgan Stanley

ETRADE, now part of Morgan Stanley, is a well-established online brokerage offering a wide variety of investment products and services, including commission-free trading for U.S.-listed stocks, ETFs, and options. The platform caters to a broad range of investors, from beginners to active traders, with intuitive tools, powerful platforms, and in-depth research provided by Morgan Stanley. ETRADE’s advanced tools, along with its educational content and retirement planning resources, make it a one-stop platform for traders and investors of all levels.

Plus500

Plus500 is a globally recognized platform for futures trading, offering a wide range of instruments including futures on equity indices, crypto, metals, forex, and more. The platform focuses on ease of use and low commissions, making futures trading accessible to both beginners and more experienced traders. Backed by over 20 years of experience, Plus500 provides professional customer support and emphasizes security by keeping client funds in segregated accounts. Plus500 is listed on the London Stock Exchange and is a full member of the CME Group and the National Futures Association (NFA).

J.P. Morgan Self-Directed Investing

J.P. Morgan Self-Directed Investing is an online platform that offers commission-free trading for U.S.-listed stocks, ETFs, and options, making it an attractive choice for investors who want control over their portfolios. It provides access to general investment accounts and retirement accounts, including Traditional and Roth IRAs. The platform features tools for comprehensive wealth management and retirement planning, supported by market insights from J.P. Morgan specialists. Investors can easily manage their portfolios through the Chase Mobile® app and online, with seamless integration for J.P. Morgan customers.

Disclaimer

The information on this page is for informational purposes only and should not be considered financial advice. You are encouraged to conduct your own research and verify all details directly with the brokerage provider before making any investment decisions. Investing involves risks, and it’s essential to ensure the chosen broker aligns with your financial goals and needs. Always review the terms, fees, and offerings provided by the broker to ensure accuracy and suitability for your individual situation.